By Erik Johnsen

For many recent and soon-to-be high school graduates, their academic careers are just beginning. Most American high school graduates will pursue post-secondary education of some kind. But for many, there is one significant obstacle in their path. College is expensive. Due to the steadily rising cost of college tuition in the United States in recent years, the cost of pursuing a college education is now higher than ever. Fortunately for these students, there are several different financial aid opportunities available to them. In this article I will discuss the burden of rising tuition costs and review many of the financial aid options available to students at UW Stout and the wider UW system.

Rising costs

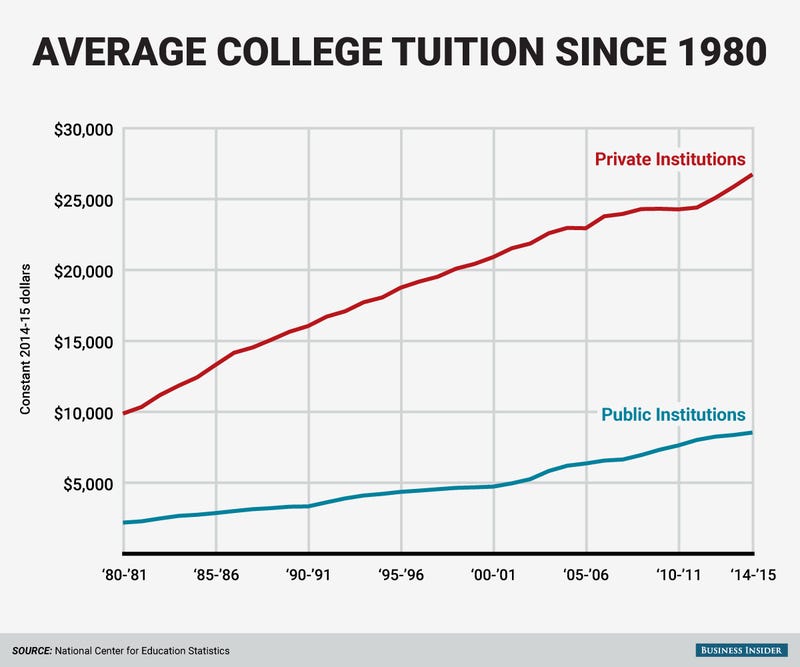

The average college tuition has been steadily rising over the last four decades. Because of this, many students are finding themselves more and more reliant on receiving financial aid in order to pursue a postsecondary education. According to Jackson and Nudelman (2016), using information from the National Center for Education Statistics, the average yearly tuition rate for public universities rose from $2,196 in 1980 to $8,534 in 2014-15.

Types of aid available

There are many different types of financial aid available to students at UW system schools. For the purposes of this article they will be broken down into three categories. These are federal financial aid, state financial aid, and military family education benefits. Scholarships offered by community organizations, businesses, and schools, along with private loans made by private, nonfederal lenders such as banks and credit unions, should also be considered as options for funding postsecondary education. However, these sources vary widely in terms of eligibility, requirements, and interest rates (for loans) and will not be covered in this review. Additionally, this is not an exhaustive list, and links to more detailed reading can be found throughout this article.

Federal Financial Aid

Federal Loans

A federal student loan is made through a loan program administered by the federal government. Loans must be repaid over time. When choosing between private and federal loans, the latter is usually the better option because they offer more benefits than private loans. For example, federal loans include fixed interest rates for all students in the same loan category and do not require a credit check.

Direct Subsidized Loans

Undergraduate students with financial need can receive subsidized loans that are backed by the US Department of Education. Interest is typically not charged on the loan for certain time periods in the life of the loan, such as when the student is enrolled in school at least half-time, or during the first 6 months after graduation, commonly known as a “grace period.” For undergraduates, loans that were disbursed for the 2019-2020 academic year (July 1, 2019 to June 30, 2020) had an interest rate of 4.53% (Federal Student Aid, 2020).

Direct Unsubsidized Loans

Students that do not show the financial need required for a subsidized student loan can take out unsubsidized loans instead. These are available to undergraduate, graduate, and professional degree students, and can be taken in addition to subsidized loans for individuals with financial need. The student is responsible for paying the interest during all periods, which begins to accumulate as soon as the loan is disbursed.

Direct PLUS Loans

These loans are designed for parents who are borrowing money to pay for their dependent undergraduate child’s education, and for graduate or professional degree students. Financial need is not required, however credit history, and ability to pay the loan back, will be taken into account when determining loan amounts.

Pell Grants

Unlike loans, Pell Grants do not need to be repaid. Provided by the federal government, these need-based grants are given to low-income undergraduate students, and may be used at any of the approximately 5,400 postsecondary institutions that participate in the federal education program. To receive a Pell Grant, you must complete the Free Application for Federal Student Aid (FAFSA) to determine eligibility. The amount of the grant is dependent on financial need, costs to attend a particular school, full- or part-time status, and plans to attend school for a full year or less.

Federal Work-Study (FWS) Program

This program helps students earn money to fund their education by providing a portion of the hourly wages that a student can receive through employment, while the educational institution provides the remainder of the wage. Students are typically employed in supportive roles at their schools, as tutors, or in community service roles. FAFSA must be completed to determine eligibility to participate in this program.

State Financial Aid

In addition to federally provided financial aid, the state of Wisconsin also provides students with aid to help to pay their college tuition at UW system schools. There are several grants offered by the state of Wisconsin. Additional information about other state education resources can be found at the State of Wisconsin Higher Educational Aids Board website at heab.state.wi.us

Wisconsin Grant

Wisconsin residents can receive this grant if they are in a degree- or certificate-seeking program at a UW system school, among others, and enrolled at least half-time. A FAFSA is required to apply for the grant, which is currently $250 to $3150 based on need. If eligible, a student may receive this grant for up to ten semesters.

Talent Incentive Program Grant

Students that have the greatest financial need may be nominated by financial aid offices or counselors in the Wisconsin Education Opportunity Programs to receive the Talent Incentive Program (TIP) Grant as first-time freshman. Initial awards range from $600 to $1800. If a student continues to have a financial need for this grant, as determined through FAFSA, it may be awarded for up to ten semesters, with a minimum of $250 for continuing awards.

Indian Student Assistance Grant

The Indian Student Assistance Grant has eligibility requirements similar to the Wisconsin Grant, with the additional requirement that the student be at least 25% Native American. However, this grant is available for both undergraduate and graduate students. Both the FAFSA and he Indian Student Assistance Grant application must be completed to determine eligibility for this grant that can range from $200 to $1100, for up to ten semesters.

Military Family Education Benefits

Students that are themselves, or have a parent or spouse who is, a veteran may be eligible for a variety of federal veteran-based benefits, depending on their situation. Additionally, Wisconsin offers the Wisconsin GI Bill for veteran students and in some cases, their spouses and children if disabled.

Federal GI Bill

The Post 9/11 GI Bill is a federal program that provides military veterans with post-secondary education benefits if they have served for more than 90 days. It includes payment for tuition and a monthly allowance for housing, as well as a stipend for supplies and textbooks.

There are a variety of additional federal veteran education benefits including the National Call to Service Program, Chapter 35 benefits for the spouse and children of disabled veterans, Fry Scholarship for spouses and children of servicemembers who lost their lives in the line of duty, and transferred GI Bills. Due to the complexity of the eligibility requirements, it is best to review the details of these program at the Veterans Administration Education Benefits website at www.benefits.va.gov

Wisconsin GI Bill

The Wisconsin GI Bill is a tuition remission program enacted in 2005 and is available to veterans who are Wisconsin residents. This program pays for the tuition and segregated fees for the veteran for 128 credits or 8 semesters, whichever is longer. The Bill also allows the same benefits to be awarded to a veteran’s spouse or children if the veteran is at least 30 percent disabled, as adjudicated by the Veterans Administration. Application is a two-step process with documentation required to be send to the Wisconsin Department of Veteran Affairs and the school that the student is attending. More information can be retrieved from https://dva.wi.gov/Pages/Home.aspx

While paying for postsecondary education can be a daunting task, systematically reviewing all of the available options is a good first step. Be aware that eligibility requirements can change over time, and you may become eligible for programs that you previously had not considered. Consult the financial aid office at your school periodically to stay up-to-date on current programs available to you.

References

Federal Student Aid. (2020). Federal interest rates and fees. Retrieved from https://studentaid.gov/understand-aid/types/loans/interest-rates

Jackson, A. & Nudelman, M. (2016). This chart shows how quickly college tuition has skyrocketed since 1980. Retrieved from https://www.businessinsider.com/this-chart-shows-college-tuition-growth-since-1980-2016-8

State of Wisconsin Higher Educational Aids Board. (2015). Financial aid programs. Retrieved from http://heab.state.wi.us/programs.html

U.S. Department of Veterans Affairs (2020). Education and training. Retrieved from https://www.benefits.va.gov/gibill/

Wisconsin Department of Veterans Affairs. (n.d.) Wisconsin GI Bill. Retrieved from https://dva.wi.gov/Pages/educationEmployment/Wisconsin-GI-Bill.aspx